Real estate housing isn’t just about finding a place to live. In 2025, it’s about understanding prices that still haven’t fully cooled down, neighborhoods that are shifting fast, and the hidden costs that catch people off guard. If you’re thinking about buying or renting, you’re not just looking at square footage-you’re betting on a future that’s changing by the month.

What’s Actually Happening in the Housing Market Right Now?

Back in 2022, home prices shot up so fast that many buyers just gave up. Two years later, things haven’t gone back to normal-they’ve settled into something weirder. Prices are still 18% higher than pre-pandemic levels in most U.S. cities, according to the National Association of Realtors. But here’s the twist: inventory is finally creeping up. In Austin, where I live, listings are up 22% compared to last year. That means more choices, but not necessarily lower prices.

Why? Because mortgage rates are still hovering around 6.5%. That’s down from 8% last year, but it’s still high enough to squeeze affordability. A $400,000 home with a 6.5% rate costs $2,500 a month in principal and interest alone. Add taxes, insurance, and maintenance, and you’re looking at $3,200+. That’s more than most renters pay in the same area.

So who’s buying? Mostly cash buyers-investors and people who sold their old homes at a profit. First-time buyers? They’re either waiting, moving to cheaper suburbs, or skipping homeownership altogether. A recent Zillow survey found that 43% of Americans under 35 now say they don’t expect to own a home in the next decade.

Buying vs. Renting: The Real Math

People say renting is throwing money away. That’s not always true. Let’s say you’re looking at a $2,800/month apartment. You pay that, you get your security deposit back, and you don’t worry about a broken water heater. Now compare that to buying a $420,000 home. Your monthly payment might be similar, but now you’re on the hook for property taxes ($4,200/year), insurance ($1,800/year), and maintenance-about 1% of the home’s value annually. That’s another $4,200. Suddenly, your real cost is closer to $3,500/month.

But here’s what most calculators miss: equity. If you buy and the home appreciates 3% a year, you’re building $12,600 in value over five years. That’s not cash in hand, but it’s an asset. Renters get nothing back. So if you plan to stay put for five years or more, buying often wins. If you’re not sure-maybe you’ll change jobs, get married, or want to travel-renting gives you flexibility that’s worth more than most people realize.

Where Are the Best Deals Right Now?

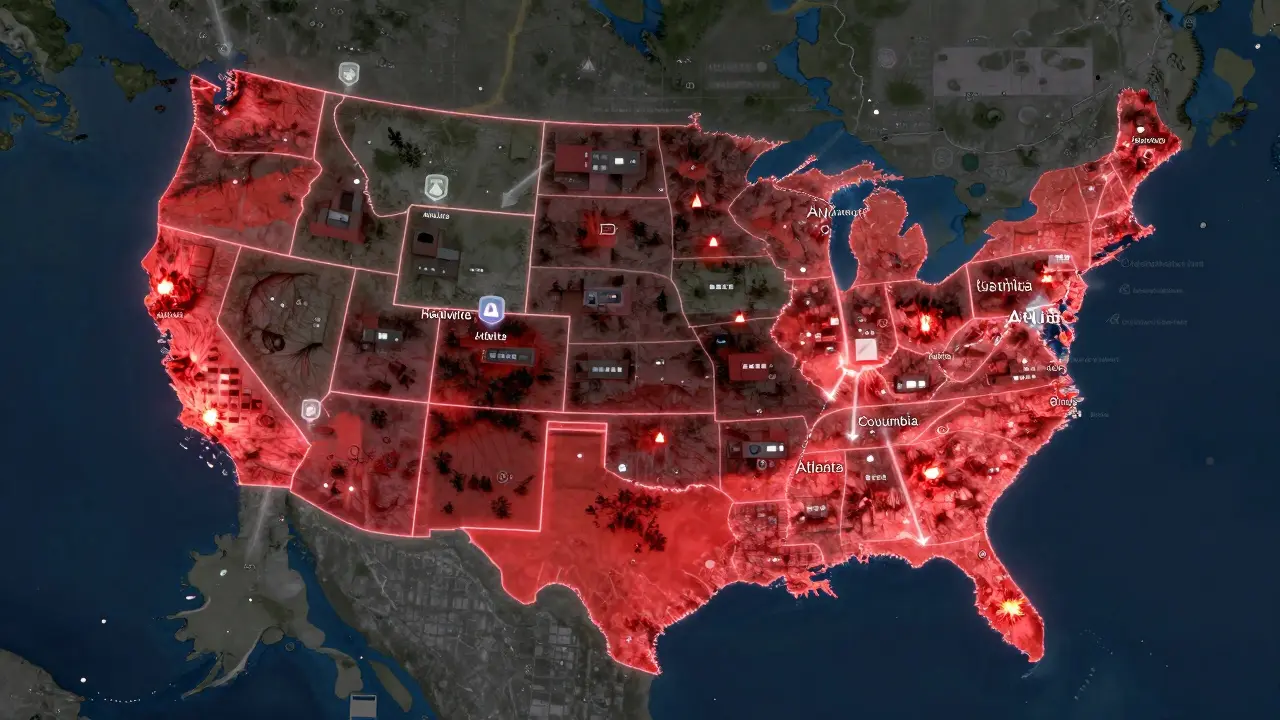

Not all markets are created equal. In places like Austin, San Francisco, or Seattle, prices are still stubbornly high. But look south and east. In cities like Nashville, Atlanta, or Raleigh, homes are selling for 10-15% less than their 2022 peaks. And they’re still growing. Nashville added over 100,000 new residents between 2020 and 2024. That kind of demand keeps prices steady, but not skyrocketing.

Even better? Smaller towns. Places like Columbia, Missouri, or State College, Pennsylvania, offer homes under $250,000 with good schools and low crime. These aren’t trendy hotspots-they’re quiet, stable, and often overlooked. If you don’t need to be in a big city, you can get a lot more house for your money.

One warning: don’t chase low prices alone. Check the job market. A cheap house in a town with shrinking employment isn’t a deal-it’s a trap. Look for areas with new employers moving in. Amazon, Tesla, and other big companies are opening distribution centers and tech hubs in places you’ve never heard of. That’s where value hides.

What Hidden Costs Don’t Get Mentioned?

Everyone talks about down payments and interest rates. Few mention the quiet killers.

- Home inspections cost $300-$600. You pay this whether you buy or not.

- Appraisal fees are $500-$700. Lenders require this, and you can’t skip it.

- HOA fees can jump from $100 to $400 a month overnight. Always ask for the last six months of statements.

- Property taxes can double after you buy. Some states reassess value right after a sale.

- Utilities in older homes? Expect 30-50% higher bills than in new builds.

And don’t forget moving costs. A local move averages $1,200. If you’re going across state lines, it’s $4,000+. That’s not in the listing. That’s out of your pocket.

How to Spot a Good Deal (Without Getting Scammed)

A house that’s been on the market for 90 days isn’t always a bargain. Sometimes it’s because the roof leaks, the foundation is cracking, or the seller is desperate. Here’s how to tell the difference:

- Check the listing history. If it’s been relisted three times in a year, dig deeper.

- Ask for the seller’s disclosure form. It’s legally required. Read it like a detective.

- Look at comparable sales. Use Zillow’s “Zestimate” as a starting point, then cross-check with local MLS data. If the home is priced 20% below similar ones, something’s wrong.

- Walk around the neighborhood at night. Are the streets lit? Are there for-rent signs everywhere? That’s a sign of decline.

- Ask the agent: “How many offers did this get?” If they say “none,” press for details. Silence is a red flag.

And never skip the home inspection. I’ve seen buyers skip it to “win” a bidding war. Two weeks later, they’re paying $18,000 to fix a bad sewer line. That’s not a risk worth taking.

What’s Next for Real Estate Housing?

By 2026, AI will be used in 60% of real estate listings to predict price trends and recommend neighborhoods. You’ll see apps that scan your commute, school ratings, and crime data in seconds. But the basics won’t change: location still matters more than finishes. A $300,000 home in a growing area will outperform a $500,000 home in a stagnant one.

Government programs are also shifting. The FHA is relaxing down payment rules for first-time buyers in high-cost areas. Some states now offer grants that cover up to 5% of your down payment if you stay in the home for five years. Check your state’s housing authority website. You might qualify for help you didn’t know existed.

And don’t ignore climate risk. Flood zones, wildfire areas, and heat islands are now part of home inspections. Insurance companies are dropping coverage in high-risk areas. If you’re looking at a home near water or in a dry forest, ask: “Has this been insured in the last two years?” If the answer is no, walk away.

Final Thought: It’s Not About Timing-It’s About Fit

People obsess over “the right time to buy.” But the real question is: “Does this home fit your life?” A big yard means nothing if you work 60-hour weeks. A walkable neighborhood doesn’t help if you hate crowds. A cheap price won’t save you if the school district is failing.

Real estate housing isn’t an investment you make because the market is hot. It’s a decision you make because the house matches your daily life. When you stop chasing trends and start matching needs, you stop overpaying. And that’s the real win.

Is now a good time to buy a house in 2025?

It depends on your situation. If you plan to live in the home for five years or more, and you can afford the full monthly cost-including taxes, insurance, and maintenance-then yes. Prices aren’t falling fast, but inventory is rising, which gives buyers more leverage. If you’re unsure about your job, income, or future plans, renting is still the smarter move.

How much do I need to make to buy a $400,000 home?

To qualify for a $400,000 home with a 20% down payment and a 6.5% mortgage rate, you’ll need a gross annual income of at least $85,000. That’s based on the 28/36 rule: no more than 28% of your income going to housing, and 36% to all debt. If you have student loans or car payments, you’ll need to earn more.

Why are homes still expensive even with high mortgage rates?

Because supply hasn’t caught up with demand. Builders are still struggling with labor shortages and material costs. Meanwhile, people are moving to new cities, starting families, or leaving rentals. There aren’t enough homes to go around, so prices stay high even when borrowing is expensive. It’s not about rates-it’s about scarcity.

Should I rent or buy if I’m in my 20s?

If you’re planning to stay in one place for five years and have stable income, buying can build wealth. But if you’re still figuring out your career, location, or relationships, renting gives you freedom. Many 20-somethings think they’re missing out by renting, but they’re actually avoiding big financial risks. There’s no shame in waiting until you’re ready.

What’s the biggest mistake first-time homebuyers make?

They focus on the house, not the neighborhood. A beautiful kitchen won’t help if the school district is failing, the streets are unsafe at night, or the property taxes will spike next year. Always research the area as much as you research the home. The house can be fixed. The neighborhood can’t.

8 Responses

It’s funny how we treat houses like stocks instead of homes. You don’t buy a house because the market is hot-you buy it because it’s where you’ll cry, laugh, and forget to take out the trash for three weeks straight. The real win isn’t equity-it’s peace. A place that doesn’t make you anxious just walking through the door. That’s rarer than a 3% mortgage.

why do ppl always talk bout equity like its magic money its not cash its just a number on a screen and what if u lose ur job or ur partner leaves u and u gotta move but ur stuck in some house with a leaky roof and HOA fees that keep going up like a horror movie i just wanna rent and not think about it ever again

They don’t want you to know this but the whole housing crisis is engineered. Big banks, foreign investors, and shadow funds are buying up everything because they know the dollar’s gonna crash. They want you renting forever so you never build real wealth. And now they’re pushing AI apps to make you feel like you need their tech to survive. Wake up. Buy in the quiet towns. Avoid the cities. Own land. That’s the only real power left.

so i read all this and i was like wow this is super detailed but then i realized like… i dont even know what my budget is. like i make 50k a year and i live with my parents and i think i might be able to afford a shed in texas but i dont even know if a shed counts as a house anymore. also why do people keep saying ‘maintenance’ like its a chore and not just a lifetime of screaming into the void

There’s so much pressure to buy, but the truth is, most of us aren’t ready-and that’s okay. You don’t have to rush into something that’ll weigh you down for decades. Renting isn’t failure. It’s patience. And patience, in this world, is a quiet kind of strength. Take your time. Build your life first. The house will still be there when you’re ready for it.

I appreciate the thoughtful analysis presented here. It is clear that housing decisions require careful consideration of both financial and personal factors. Many individuals overlook the emotional component of stability, which is often more valuable than market trends. A home should serve the person, not the other way around. I encourage all readers to reflect on their long-term goals before making any commitment.

What about climate risk data? Is it actually reliable? I saw a house listed as ‘low flood risk’ and then found out the county changed the flood zone map two months after the sale. Are these AI tools just guessing based on outdated info? And who’s auditing them? I feel like we’re trusting algorithms that don’t even understand how weather works anymore.

You’re not behind. You’re not failing. If you’re 25 and renting, you’re not wasting time-you’re gathering data. Every place you live teaches you something. What kind of neighbor do you want? What kind of commute can you handle? What does safety really mean to you? The house will come when you know who you are. Until then, protect your peace. That’s the real down payment.