Buying property in Rajkot isn’t just about finding a house-it’s about locking in value before the city explodes. Over the last five years, Rajkot’s population has grown by nearly 18%, and infrastructure spending has jumped 40% according to Gujarat’s Urban Development Department. That’s not noise. That’s momentum. If you’re looking for real estate investments in Rajkot that actually pay off, you need to know where the money’s flowing and where the risks hide.

Why Rajkot Is Different From Other Tier-2 Cities

Rajkot doesn’t have the flashy skyline of Pune or the startup buzz of Hyderabad. But it doesn’t need to. It’s steady. Reliable. Built on decades of industrial growth, strong family-owned businesses, and a culture that values land as security. Unlike cities where prices are driven by speculative buyers, Rajkot’s market is anchored by local demand-people who live here, work here, and want to own property here.

The city’s GDP growth hit 7.3% in 2024, led by manufacturing, gemstone processing, and agro-processing. That means steady jobs. That means people need homes. That means rental demand stays high even during economic dips. In 2023, average rental yields in Rajkot were 6.8%, higher than Ahmedabad’s 5.9% and Surat’s 6.1%. That’s not a fluke. That’s structure.

Best Areas for Real Estate Investments in Rajkot

Not all neighborhoods in Rajkot are created equal. Some are rising. Some are stuck. Here’s where the smart money is going in 2025:

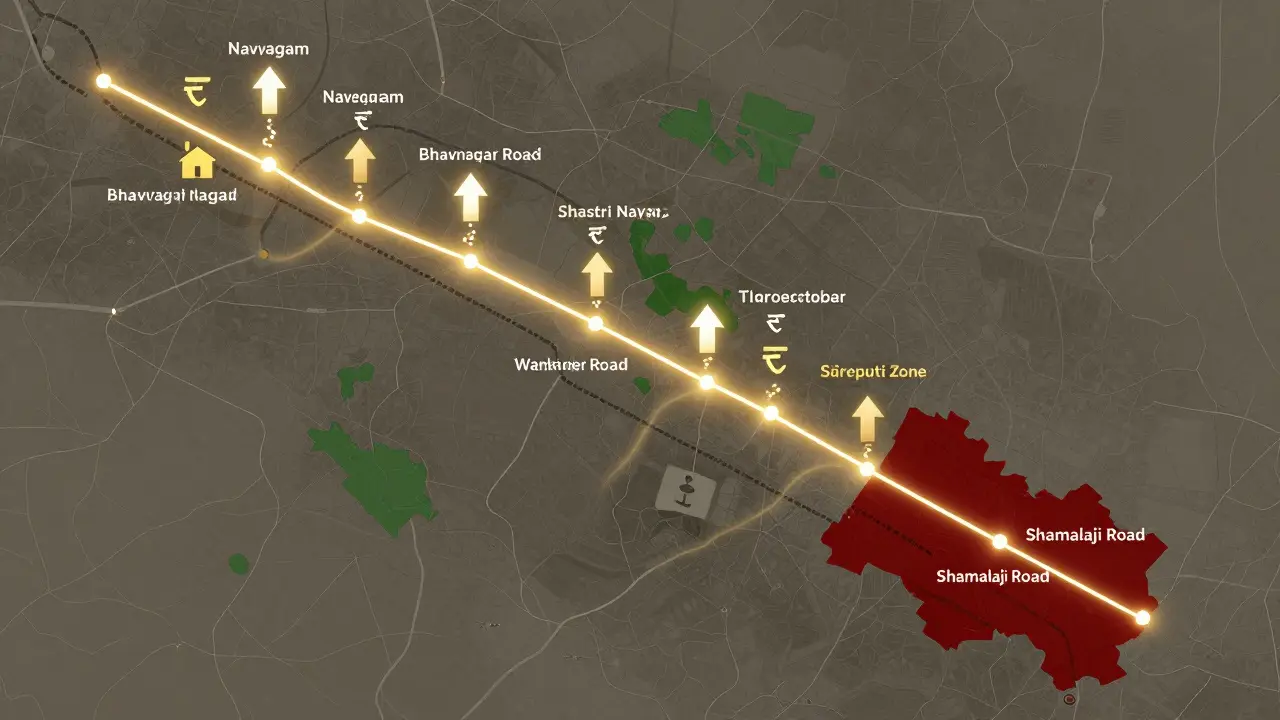

- Wankaner Road - This corridor is becoming the new commercial spine of the city. New IT parks, hospitals, and shopping centers are popping up. Property prices here have risen 22% in the last two years. If you buy now, you’re getting in before the next wave of developers arrive.

- Sardar Patel Ring Road - The government is expanding this ring road to connect all major highways. Plots near the upcoming interchanges are selling fast. Residential plots here start at ₹2,500 per sq.ft., up from ₹1,600 in 2022. Build a house here, rent it out, and you’ll have tenants lining up.

- Jamnagar Road - Popular with middle-class families. Good schools, clinics, and local markets. Apartments here sell for ₹4,200-₹5,500 per sq.ft. with 5-6% rental yields. Low risk, steady returns.

- Navagam - The city’s most affordable area. Prices are still under ₹2,000 per sq.ft. But new metro connectivity plans (approved in 2024) could double values in 3-5 years. Buy now, sell later.

- Shamalaji Road - Avoid this area. It’s overcrowded, lacks drainage, and has no planned infrastructure upgrades. You’ll get a cheap price-but you’ll pay for it in maintenance and low resale value.

What You’ll Pay in 2025

Prices vary wildly depending on location, type, and condition. Here’s what you’re actually paying right now:

| Property Type | Price Range (₹/sq.ft.) | Rental Yield (%) | Appreciation (Last 3 Years) |

|---|---|---|---|

| Residential Plot (Wankaner Road) | ₹3,200-₹4,500 | 5.2% | 28% |

| 2BHK Apartment (Jamnagar Road) | ₹4,200-₹5,500 | 6.5% | 19% |

| 3BHK Villa (Sardar Patel Ring Road) | ₹5,800-₹7,200 | 5.8% | 24% |

| Commercial Shop (Wankaner Road) | ₹8,000-₹11,000 | 8.1% | 33% |

| Industrial Plot (Bhavnagar Road) | ₹1,800-₹2,400 | 7.3% | 16% |

Notice something? Commercial properties and industrial plots are outpacing residential. Why? Because Rajkot’s small and medium businesses are expanding fast. A shop in Wankaner Road isn’t just a store-it’s a cash machine. One owner I spoke to rents out his 500 sq.ft. shop for ₹45,000/month. His mortgage? ₹18,000. That’s pure profit.

How to Avoid Getting Scammed

Rajkot’s real estate market is still mostly unregulated. Many developers don’t have RERA registration. Many sellers don’t have clear titles. Here’s how to protect yourself:

- Always check the property’s title deed at the Sub-Registrar Office. Look for encumbrances, previous loans, or disputes.

- Verify RERA registration using the Gujarat RERA portal. If the project isn’t listed, walk away.

- Don’t pay more than 10% as advance without a signed agreement. Many builders vanish after collecting deposits.

- Use a local lawyer-not a friend who ‘knows someone.’ A good property lawyer in Rajkot costs ₹15,000-₹25,000. That’s cheaper than losing ₹20 lakhs.

- Ask for the occupancy certificate. Without it, you can’t get water, electricity, or a loan in your name.

One investor bought a flat in 2023 thinking it was RERA-approved. Turns out, the builder had only registered Phase 1. Phase 2 was never approved. The buyer lost ₹12 lakhs and spent 18 months in court. Don’t be that person.

Financing Your Investment

You don’t need to pay cash. But you need to pick the right loan.

Most banks in Rajkot offer home loans at 8.5-9.25% interest. But here’s the trick: if you’re buying a commercial property, interest rates jump to 10-11%. That’s because banks see commercial real estate as riskier. If you’re buying a shop, make sure your rental income covers the EMI by at least 1.5x.

Some NBFCs offer 100% financing for plots-but only if you’re buying in a registered layout. Don’t fall for ‘no down payment’ offers on unapproved land. That’s a trap.

Use your savings to cover 20-30% upfront. That gives you breathing room if rents drop or repairs come up. Never stretch to 90% loan-to-value. Rajkot’s market is stable-but not bulletproof.

Who Should Invest Here? Who Should Stay Away?

Real estate investments in Rajkot work best for:

- Local professionals - Doctors, engineers, or business owners who want to build wealth without leaving the city.

- NRIs with family ties - If your parents or siblings live here, you already know the culture. You can manage rentals remotely.

- Long-term investors - People who can wait 5-7 years. Rajkot’s growth isn’t overnight. It’s a slow burn.

Stay away if you:

- Want quick flips. The resale market is slow. It takes 4-6 months to sell a property here.

- Expect 15% annual returns. That’s Mumbai or Delhi talk. Rajkot gives you 8-10% over time. It’s not sexy-but it’s real.

- Don’t want to deal with paperwork. This isn’t a passive investment. You need to stay involved.

The Future: What’s Coming Next?

Three big projects will shape Rajkot’s real estate in the next 5 years:

- Rajkot Metro Rail - Phase 1 (Bhavnagar Road to Wankaner Road) is under construction. Stations at Navagam, Shastri Nagar, and Gondal Road will boost nearby property values by 30-40%.

- Rajkot Smart City - 27 projects underway, including digital governance, waste management, and pedestrian zones. Areas near these upgrades are already seeing higher demand.

- New Airport Expansion - The airport will handle 10 million passengers annually by 2027. Hotels, warehouses, and logistics hubs are being planned around it. Land near the airport is cheap now-buy before the zoning changes.

These aren’t rumors. They’re approved by the state government and funded by the central government’s Smart Cities Mission. If you’re buying in the right spot, you’re not just investing in land-you’re investing in the city’s future.

Final Thought: Don’t Chase Hype. Chase Stability.

Rajkot won’t make you rich overnight. But if you buy smart, you’ll never lose money. The city doesn’t need flashy ads or viral TikTok trends. It just needs people who want a home, a shop, or a factory. And those people will always be here.

Don’t compare it to Bengaluru. Don’t try to time the market. Just pick a good location, verify the documents, and hold on. In 5 years, you’ll look back and wonder why you didn’t start sooner.

Is now a good time to buy property in Rajkot?

Yes, if you’re looking for long-term growth. Prices are still reasonable compared to other Indian cities, and major infrastructure projects like the metro and airport expansion are just starting. Buying now lets you lock in lower prices before demand surges.

What’s the average rental yield in Rajkot?

Residential properties average 6-7% rental yield. Commercial spaces like shops and offices can hit 8-9%. Industrial plots offer 7-8%. These are among the highest yields in Gujarat’s tier-2 cities.

Which area in Rajkot has the highest appreciation?

Wankaner Road and Sardar Patel Ring Road have seen the highest appreciation over the last three years-22-33%-due to new commercial developments and infrastructure projects. Navagam is the next area to watch because of upcoming metro connectivity.

Can NRIs invest in real estate in Rajkot?

Yes, NRIs can buy residential and commercial property in Rajkot without special permission. But they cannot buy agricultural land. All transactions must go through a bank in India, and the property must be registered in their name with proper documentation.

How long does it take to sell a property in Rajkot?

On average, it takes 4 to 6 months to sell a property in Rajkot. The market is steady but not fast-moving. Buyers are cautious, and documentation checks take time. Price your property realistically and be patient.

Are there any tax benefits for real estate investors in Rajkot?

Yes. Home loan interest up to ₹2 lakh per year is deductible under Section 24. Principal repayment up to ₹1.5 lakh is deductible under Section 80C. If you rent out the property, you can claim deductions for maintenance, property tax, and depreciation. Consult a chartered accountant for exact filings.