When you hear "Aurangabad", you might think of the Ajanta and Ellora caves. But behind the history, a quiet real estate boom is happening. In 2025, property deals in Aurangabad are offering some of the best entry points for investors and first-time buyers in Maharashtra outside Pune and Mumbai. Prices haven’t spiked like in metro cities, but demand is rising fast - especially near industrial zones, educational hubs, and new road projects.

Why Aurangabad Is Picking Up Steam

Aurangabad isn’t just a tourist stop anymore. It’s becoming a logistics and manufacturing hub. The Maharashtra Industrial Development Corporation (MIDC) expanded three industrial areas between 2022 and 2024 - Aurangabad MIDC, Chikhali, and Peint. Companies like Tata Motors, Mahindra, and Godrej have set up new plants here. That means jobs. And jobs mean people needing homes.Since 2023, residential demand has grown by 27% year-over-year, according to local real estate associations. The average price per square foot in established neighborhoods like CIDCO, Bhagwanpura, and Sakegaon jumped from ₹3,200 in 2022 to ₹4,100 in late 2024. But compared to Pune’s ₹8,500/sq.ft, that’s still a bargain.

Where to Look for Real Deals Right Now

Not all areas in Aurangabad are equal. Some parts are overpriced. Others are hidden gems. Here’s where the real value is in 2025:- CIDCO (City and Industrial Development Corporation): The most mature township. Water supply, roads, schools, and hospitals are all in place. New projects here start at ₹4,300/sq.ft. Look for off-plan units from developers like Shapoorji Pallonji and Sama Group - they often offer 10-15% discounts for early bookings.

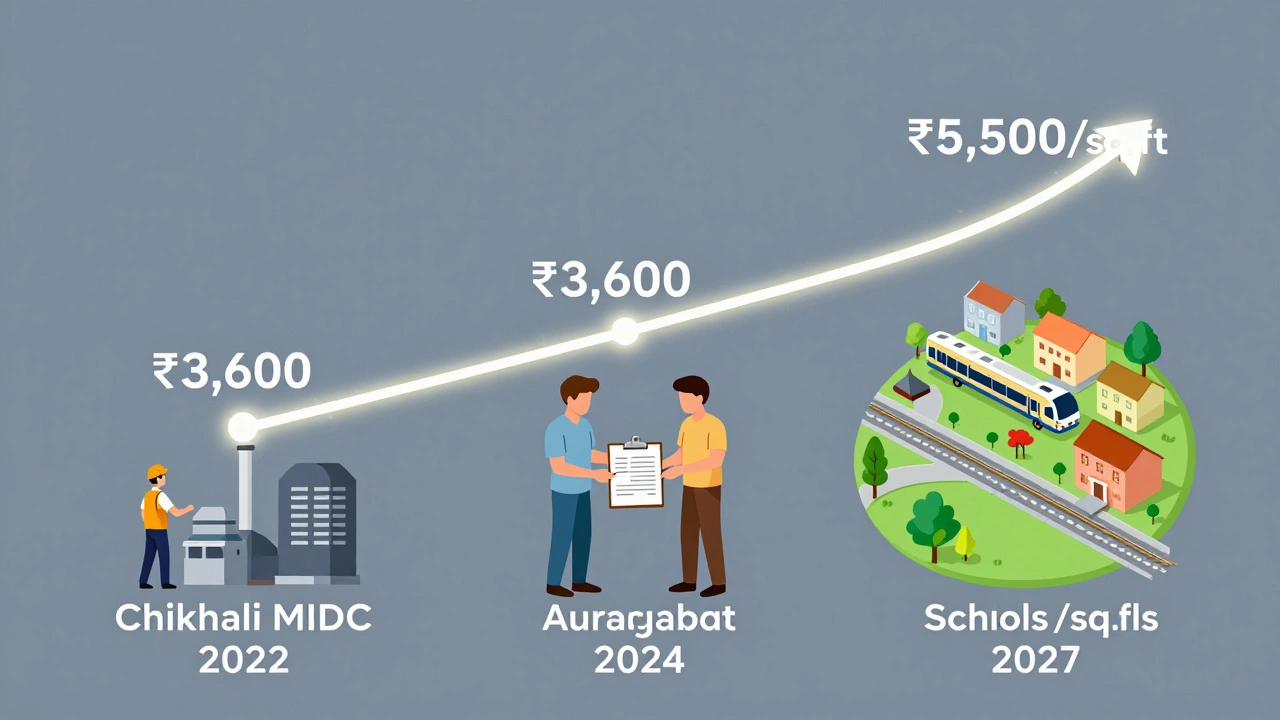

- Chikhali (near MIDC): If you work in manufacturing or logistics, this is your sweet spot. Prices are around ₹3,600/sq.ft, and many projects include free parking and 24/7 security. New metro rail extensions are planned here by 2027, which will push prices up fast.

- Peint: A quieter, greener option. Ideal for families. Land parcels here are selling for ₹2,800-3,100/sq.ft. Many buyers are buying plots and building later. The government is upgrading water and power infrastructure, so this area will likely see 20%+ appreciation in the next three years.

- Shendra-Bidkin Industrial Area: Still developing, but home to Amazon’s new logistics center. Property rates are low - ₹2,500-2,900/sq.ft - but riskier. Only buy here if you’re planning to hold for 5+ years.

Types of Deals You Can Find

You’re not just looking for apartments. In Aurangabad, the market offers flexibility:- Ready-to-move apartments: Best for people who need to move in fast. Prices start at ₹35 lakh for a 2BHK in CIDCO. Most come with basic fittings and parking.

- Off-plan projects: These offer the biggest savings. Developers like Godrej Properties and Kolte-Patil are offering 12-18 month payment plans with 0% interest. You can lock in at ₹3,800/sq.ft today and pay over time - even if prices rise to ₹4,800 by completion.

- Resale properties: Older homes in CIDCO and Bhagwanpura are selling fast. Many are 5-10 years old, well-maintained, and priced 20% below new builds. You’ll find 3BHKs under ₹60 lakh.

- Plot purchases: If you’re building your own house, plots in Peint and near the airport road are available for ₹2,500-3,000/sq.ft. Make sure the land has clear title and is approved for residential use.

What to Watch Out For

Aurangabad’s market is growing, but it’s not foolproof. Here are three common traps:- False "RERA-registered" claims: Some small builders say they’re RERA-registered but only list the project on the portal without proper approvals. Always check the Maharashtra RERA website using the project number. If you can’t find it, walk away.

- Overpromised amenities: Ads show swimming pools, gyms, and clubhouses - but many projects deliver only basic infrastructure. Ask for the approved layout plan. If the amenities aren’t shown on the plan, they’re not guaranteed.

- Unclear land titles: Especially with plots. Make sure the seller has the original sale deed and no pending court cases. Hire a local advocate to do a title search - it costs ₹5,000-7,000 but saves you from losing lakhs later.

Financing and Tax Benefits

If you’re buying your first home, you can save money:- Home loan interest deduction: Under Section 24 of the Income Tax Act, you can claim up to ₹2 lakh per year in interest paid.

- Principal repayment deduction: Up to ₹1.5 lakh under Section 80C.

- Stamp duty exemption: Maharashtra offers a 1% stamp duty concession for women buyers until March 2026.

- Lower registration fees: Aurangabad charges 1% registration fee (vs. 5% in Mumbai), making it one of the most affordable places in Maharashtra to buy.

Many banks like SBI, HDFC, and ICICI offer home loans at 8.25-8.75% interest for first-time buyers. A ₹50 lakh loan over 20 years costs around ₹41,000/month. Compare EMIs - don’t just go with the first offer.

Who Should Buy Here?

This isn’t for everyone. But if you fit one of these profiles, Aurangabad is worth your attention:- Young professionals moving from Mumbai/Pune: You want more space, lower costs, and a slower pace. Aurangabad gives you that.

- Parents buying for their kids: With good colleges like IIM and Symbiosis nearby, buying a home now means your child has a stable place to live for four years.

- NRIs with family ties: If you have relatives here, buying property is easier than renting long-term. Plus, rental yields are 5-7% annually - better than most tier-2 cities.

- Investors with a 5-year horizon: If you’re not planning to sell next year, Aurangabad’s infrastructure push makes it a solid bet. Prices could double by 2030.

Next Steps: How to Start

Don’t rush. Here’s a simple 5-step plan:- Define your goal: Are you buying to live in, rent out, or flip? This changes everything.

- Set your budget: Include stamp duty, registration, legal fees, and furnishing. Add 10% buffer.

- Visit three neighborhoods: Spend a full day in CIDCO, Chikhali, and Peint. Talk to residents. Ask about water supply, power cuts, and safety.

- Check RERA and title: Use the Maharashtra RERA portal. Hire a local lawyer for title verification.

- Negotiate: Most sellers expect a 5-8% discount. Ask for free parking, flooring upgrades, or waived maintenance fees.

There’s no magic formula. But in Aurangabad, patience and research pay off more than hype.

Are property prices in Aurangabad rising fast?

Yes, but slowly compared to bigger cities. Prices rose 18-22% from 2022 to 2024, mostly in areas near industrial zones and new roads. The growth is steady, not speculative. You won’t see 50% jumps overnight, but 10-15% annual gains over the next 3-5 years are realistic.

Is it better to buy a flat or a plot in Aurangabad?

It depends on your timeline. If you need to move in within a year, buy a ready flat - especially in CIDCO or Bhagwanpura. If you’re planning to build a home in 2-3 years, a plot in Peint or near the airport road gives you more control and better long-term returns. Plots are cheaper upfront, but you’ll need to budget for construction and approvals.

Can NRIs buy property in Aurangabad?

Yes, NRIs can buy residential property in Aurangabad without special permission. You can’t buy agricultural land, but apartments, villas, and plots for personal use are fine. You’ll need a PAN card and an Indian bank account. Rental income can be repatriated after paying taxes.

What’s the average rental yield in Aurangabad?

Rental yields range from 5% to 7% annually. A 2BHK apartment in CIDCO rents for ₹12,000-₹16,000/month. If you bought it for ₹50 lakh, that’s a 3-4% yield. But if you bought it for ₹40 lakh during a discount offer, your yield jumps to 5-6%. Properties near colleges and hospitals rent faster and stay occupied longer.

How long does it take to get possession in new projects?

Most RERA-registered projects in Aurangabad deliver within 24-30 months from booking. Delays happen, but RERA forces developers to pay 10% interest on the paid amount for every month of delay. Always check the project’s RERA timeline before paying the first installment.

Is Aurangabad a good place for long-term investment?

Absolutely. With industrial expansion, improved highways, and upcoming metro rail, Aurangabad is on the path to becoming a mid-sized urban center. Infrastructure spending by the state government is expected to cross ₹12,000 crore by 2027. Property values in core areas could increase by 2-2.5x over the next 10 years. If you buy now, you’re getting in before the big surge.

12 Responses

I've been watching Aurangabad for a while now. The CIDCO area is solid, but I'm more drawn to Peint. The land prices are still reasonable, and the green spaces make it feel like a real place to raise a family. No rush, but I'm saving up to buy a plot next year.

Oh please. 'Best entry point'? You mean the place where half the 'RERA-registered' projects are just shell companies with fake approvals? And don't get me started on the '20% appreciation' claims-those are the same people who told you Bitcoin would hit $100K by 2024. Wake up. This isn't investment; it's wishful thinking dressed up as a guide.

Madhuri, you're right to be skeptical-but don't throw the baby out with the bathwater. If you verify RERA status, hire a local advocate for title checks, and stick to developers with 5+ years of track record (like Sama or Godrej), Aurangabad offers real value. I helped a client buy in Chikhali last year-RERA-registered, possession in 22 months, no delays. It’s doable if you do your homework.

This is the kind of hidden gem that makes India’s next decade so exciting! Forget Mumbai’s overpriced shoeboxes-Aurangabad is where the future is being built, brick by brick, with real people, real jobs, and real potential. I’ve seen guys turn ₹40L into ₹1.2Cr in five years just by buying in Shendra and holding tight. The grind isn’t glamorous, but the payoff? Pure magic.

I just moved here from Delhi. The air is cleaner, the people are kind, and I got a 3BHK for less than what my cousin paid for a 1BHK in Noida. No fancy malls, but there’s a great chai stall next to the park. Feels like home already.

Value? More like the last stop before the desert. If you’re not buying for family ties or nostalgia, you’re just chasing a mirage. Also, 'decent home without selling a kidney'? That’s not a selling point-that’s a warning label.

Great breakdown. I’d just add-talk to the security guards and local shop owners. They know which projects are actually moving, which ones are stuck, and who’s really paying their bills. I learned that the hard way when I bought into a 'ready-to-move' project that was still digging foundations two years later.

There’s a comma missing after 'logistics' in the second paragraph. Also, '₹3,200 in 2022 to ₹4,100 in late 2024'-should be '₹3,200 in 2022 to ₹4,100 by late 2024.' And '0% interest' needs a hyphen: '0%-interest.' Small things, but they matter.

If you’re young and planning to stay put for a few years, this is the smartest move you can make right now. No one’s shouting about it, no influencers are posting selfies in front of construction sites-but that’s exactly why it’s worth it. Quiet growth beats loud hype every time.

It is imperative to note that the term 'decent home' is both subjective and misleading. Furthermore, the assertion that property values 'could double by 2030' lacks empirical substantiation and constitutes speculative extrapolation unsupported by authoritative economic modeling. One must exercise extreme caution in financial decision-making.

They’re all lying. The government is using this to push people out of Mumbai. The metro rail? Fake. The industrial zones? Mostly empty warehouses. They’re just hyping this so the rich can buy cheap land and flip it later. I saw a guy get scammed last year-he paid for a plot that turned out to be a government forest reserve. Don’t fall for it.

While the article presents a generally optimistic outlook on Aurangabad’s real estate market, it fails to adequately address the systemic risks associated with informal land transactions, particularly in areas such as Shendra-Bidkin. The notion that 'plot purchases are affordable' is dangerously reductive; without due diligence, one risks acquiring land subject to encumbrances, litigation, or non-conforming zoning. Furthermore, the recommendation to 'negotiate a 5-8% discount' implies a transactional culture that may undermine formal legal processes. A more rigorous, legally grounded approach is not merely advisable-it is non-negotiable for any responsible investor.