Attending a real estate seminar sounds like a smart move-if you’re trying to break into property investing or level up your skills. But let’s be honest: not all seminars are worth your time. Some are just fancy sales pitches in suits. Others? They actually change how you think about money, risk, and long-term wealth. The difference isn’t the venue or the speaker’s title. It’s the content.

What a Real Real Estate Seminar Actually Covers

A good real estate seminar doesn’t start with, “Buy this course and you’ll be rich.” It starts with, “Here’s how the market really works right now.” In 2025, interest rates are still hovering around 6.5%, and housing inventory in places like Boulder, Austin, and Denver is tight. That means flipping houses isn’t the easy win it was in 2021. But rental properties? They’re still solid-if you know how to pick them.

Top seminars break down real numbers: cap rates in suburban Atlanta, property tax reassessment rules in California, how Section 8 housing vouchers affect cash flow in Ohio. They don’t just say “cash flow is king.” They show you the math: a $300,000 property with $2,100 monthly rent, $1,400 in expenses, and a $1,800 mortgage? That’s $700 a month in positive cash flow before taxes. That’s real. That’s actionable.

They also cover hidden costs most beginners miss. Insurance spikes after natural disasters. HOA fee increases. Tenant turnover expenses. One attendee in a 2024 Denver seminar learned his $2,000/month rental had a $900 annual pest control bill he never budgeted for. That’s the kind of detail that turns a “good deal” into a money pit.

Who Should Go-and Who Should Skip It

If you’ve never owned a property and you’re wondering whether to rent or buy, a seminar can help. If you’ve been renting for years and want to build wealth without relying on your 401(k), it’s worth it. If you’re a W-2 employee looking for side income, this is one of the few paths that scales without trading time for money.

But if you already own three rentals and manage them yourself? You might be better off networking with local property managers or reading recent IRS updates on depreciation rules. Seminars aren’t for experts-they’re for people who are still figuring out the basics.

Same goes for people who want “get rich quick” magic. Real estate isn’t a lottery. It’s a slow, methodical game of patience, research, and execution. If the seminar promises you’ll own five homes in 12 months with no money down, walk out. That’s not education. That’s fantasy.

How to Pick the Right Seminar

Not all seminars are created equal. Here’s how to spot the ones that deliver real value:

- Check the speaker’s track record. Don’t just look at their LinkedIn. Ask: Have they actually bought and held properties in the last five years? Or are they just selling a course? Real investors will show you their portfolio-rental income statements, property tax records, even signed leases. If they won’t, that’s a red flag.

- Look for local focus. A seminar on Florida rental laws won’t help you in Colorado. Demand content tailored to your region. Property taxes, landlord-tenant laws, and zoning rules vary wildly by state-even by county.

- Ask about post-seminar support. The best ones offer free Q&A calls for 30 days after. Some even connect you with local mentors. That’s how you turn theory into action.

- Watch for upsells. If the whole event feels like a funnel to a $5,000 coaching program, you’re being sold. A real seminar might offer a $97 workbook or a 30-minute consultation. That’s fine. Anything over $500 without a clear refund policy? Run.

In 2025, the most respected seminars are hosted by local real estate investment associations (REIAs). These are nonprofit groups run by actual investors-not salespeople. Find one in your city. Attend a free meetup first. See if the people there are talking about real deals, not hype.

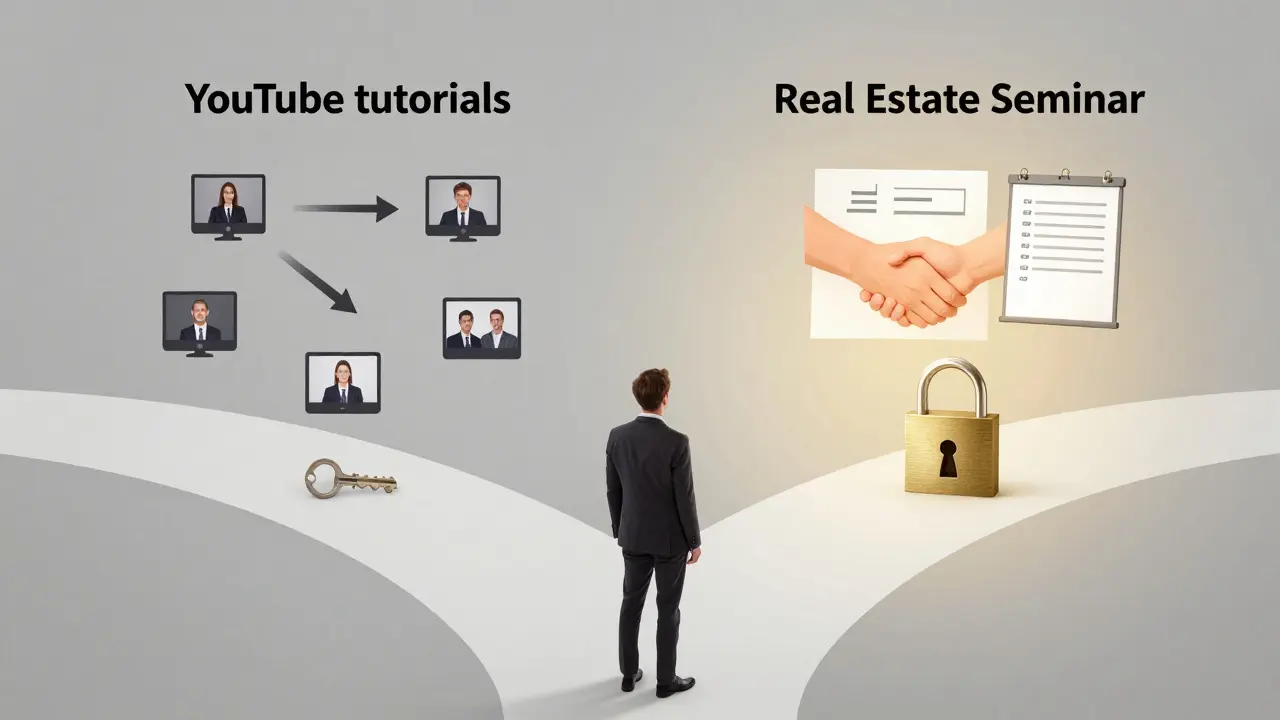

What You’ll Learn That You Can’t Get from YouTube

YouTube is full of real estate gurus. But most of them are creating content for views, not for your success. A seminar gives you something YouTube can’t: interaction.

You can ask: “I found a property with a $1,200 mortgage and $1,800 rent-but it needs $15,000 in repairs. Is that still a good deal?” And get a real answer from someone who’s done it. You can see how they run the numbers on a whiteboard. You can hear the hesitation in their voice when they say, “That roof is going to fail in two years.” That’s intuition you can’t get from a 10-minute video.

Also, seminars often include live deal reviews. Someone brings a property listing. The group breaks it down: cash flow, ROI, exit strategy. You see how experienced investors think on their feet. That’s the kind of thinking that saves you from a bad purchase.

What to Bring-and What to Leave at Home

Don’t go in with just a notebook. Bring:

- A calculator (or a phone with a good spreadsheet app)

- A list of your financial goals: “I want $1,000/month in passive income by 2027”

- Questions about your local market: “What’s the average vacancy rate in my neighborhood?”

- A pen and paper-yes, paper. Studies show writing things down improves retention by 40%.

Leave behind:

- Your credit card. Don’t buy anything on the spot. Walk away and sleep on it.

- Your ego. If someone says something that contradicts what you’ve heard online, don’t argue. Listen. Learn.

- Your assumption that you need to buy a property right away. The goal of the seminar isn’t to sell you a house. It’s to teach you how to evaluate one.

What Happens After the Seminar

The real work starts after you leave. Most people go to a seminar, get excited, then do nothing. That’s why 87% of attendees never buy their first property, according to a 2024 survey by the National Association of Real Estate Investors.

Here’s how to avoid that:

- Write down one action. Not ten. One. “I will find three listings in my target neighborhood by Friday.”

- Call a local property manager. Ask them: “What kind of tenants do you see in this area? What repairs come up most often?”

- Run the numbers on one property. Use a free online calculator. Input rent, taxes, insurance, maintenance. See what the cash flow looks like. Don’t guess. Calculate.

- Go to another event. Real estate knowledge builds over time. Attend a second seminar, or join a local REIA group. Consistency beats intensity.

The people who succeed don’t find the perfect property. They find the first property-and learn from it. Even if it’s a bad one. That’s how you build experience.

Real Estate Seminar vs. Online Course

Online courses are cheaper. They’re convenient. But they’re passive. You watch. You pause. You forget.

A real estate seminar is active. You hear the questions others ask. You see the hesitation in a speaker’s voice when they say, “That’s not a good deal.” You get feedback. You’re held accountable by the group.

Think of it like learning to drive. You can watch a thousand YouTube videos about shifting gears. But until you’re behind the wheel with a real instructor telling you, “You’re letting the clutch slip,” you’re not ready.

That’s why a live seminar-even if it costs $150-is often worth more than a $50 online course. You’re not just learning facts. You’re learning judgment.

Final Thought: It’s Not About the Seminar

The real estate seminar isn’t the magic key. It’s the first step. The real value comes from what you do after you leave. One person I met at a Denver seminar spent six months studying zoning laws before buying a duplex. Another spent a year shadowing a property manager. Both are now earning $4,000 a month in passive income.

You don’t need to be rich. You don’t need to know everything. You just need to start. And a good seminar? It gives you the map. The rest? That’s your job.

Are real estate seminars worth the money?

Yes-if you pick the right one. A $100 seminar that teaches you how to calculate cash flow, spot red flags in listings, and understand local laws is worth far more than a $2,000 course that just sells you a “system.” Look for speakers who own property, share real numbers, and don’t push expensive upsells. Free local REIA meetups are often just as valuable.

What should I bring to a real estate seminar?

Bring a notebook, a calculator, your financial goals, and a list of questions about your local market. Don’t bring your credit card. Avoid buying anything on the spot. The goal is to learn, not to spend. Writing things down helps you remember them later.

Can I learn real estate investing without attending a seminar?

Yes, but it’s harder. Online courses, books, and podcasts can teach you the basics. But you won’t get the live feedback, real-time deal analysis, or mentorship that comes from being in a room with experienced investors. Seminars help you avoid costly mistakes by showing you what others have already learned the hard way.

How do I find a good real estate seminar near me?

Search for your local Real Estate Investors Association (REIA). These are usually nonprofit groups run by actual investors-not salespeople. Attend a free meetup first. Check their website for upcoming seminars. Look for speakers who own rental properties and share actual financial data. Avoid anyone who promises “no money down” or “guaranteed returns.”

Do I need to buy property after attending a seminar?

No. The goal of a real estate seminar is to teach you how to evaluate deals-not to pressure you into buying. Many attendees spend months or even years studying before making their first purchase. That’s smart. The best investors don’t rush. They prepare.

10 Responses

Really appreciated this breakdown. I went to a seminar last year that felt like a cult meeting until I found a local REIA meetup. No upsells, just real people sharing their first rental horror stories and how they fixed them. Changed everything for me.

Still haven't bought anything yet, but now I know what to look for. That $900 pest control bill? Yeah, I'm checking for that now.

The distinction between passive consumption of content and active engagement in live discourse is not merely pedagogical; it is epistemological. The seminar environment facilitates dialectical inquiry, wherein the participant is not merely a recipient of information but an interlocutor in a collective process of epistemic refinement.

Consequently, the value proposition of the live seminar transcends the transactional nature of digital media, which is inherently fragmented and devoid of contextual accountability. One cannot derive tacit knowledge from a YouTube algorithm.

Ugh. Most people who go to these seminars are just looking for a magic pill. You think a $150 seminar is going to turn you into a real investor? You need to already have capital, connections, and a brain.

And don't even get me started on 'REIA meetups.' Half the people there are just there to network so they can sell you a $5k course later.

This post is so long I got bored halfway through. All these seminars are just scams. People who go to them are suckers. I made my first 100k flipping houses with no money down and zero education. You're wasting your time reading this. Just buy a house.

OMG YES to the paper notebook thing. I write everything down and it sticks like glue. I went to one of these last spring and jotted down a tip about property tax reassessment in Texas - turned out to be the key to my first deal.

Also, don’t skip the Q&A calls. I asked a question about tenant screening and ended up getting connected to a mentor who helped me avoid a total disaster. Real people > real gurus.

You don’t need to be rich. You just need to be curious. And willing to write stuff down. Seriously, try it.

I went to a seminar in Phoenix and the speaker was a dude who owned 12 rentals. He didn't sell anything. Just showed his bank statements and said 'here's how I did it.' Best 2 hours of my year. Now I'm looking at a duplex in Tucson. No credit card, no rush. Just learning.

I hate these seminars. They're all the same. Fake experts. Fake numbers. Fake hope. I went once. Left with a $200 workbook and a bad headache. Now I just watch YouTube and do my own math.

So proud of you for even considering this 😊

Real estate isn't about being rich - it's about being prepared. That calculator tip? Gold. That paper notebook? Even better.

You got this 💪📈 Let me know if you need help running numbers - happy to chat!

Seminars? More like government-approved propaganda. Did you know the IRS changed depreciation rules in 2023 and they didn't even mention it? And the REIA? They're all tied to big real estate firms. You think they want you to know how to avoid overpaying? No. They want you to buy so they get their cut. Wake up.

Look, if you're not American, you don't get it. This country built real wealth through property. Not crypto. Not NFTs. Not some fancy course from some guy in Florida.

You want to get rich? Buy land. Buy houses. Buy in America. The rest of the world is garbage. Seminars? Fine. But only if they're run by real Americans who own property here. No foreigners, no foreigners teaching you. This is OUR system.

And if you think you can learn this from a podcast, you're already behind. Get out there. Get your hands dirty. And stop listening to these fake experts who don't even know what a deed is.