If you’ve ever bought Bitcoin, traded Ethereum, or held any crypto asset, you’ve probably wondered: how crypto regulations work? It’s not just about governments stepping in to stop innovation. It’s about protecting people, stopping crime, and making sure the system doesn’t collapse under its own weight. And right now, in 2025, those rules are clearer than ever - if you know where to look.

Who Makes the Rules?

Crypto regulations aren’t made by one global boss. They’re stitched together by national agencies, each with their own priorities. In the U.S., the SEC goes after crypto projects that act like unregistered securities. The IRS treats crypto like property - every trade, every sale, every airdrop is taxable. The FinCEN tracks money flows to stop laundering. The CFTC watches derivatives and futures markets. And state-level regulators like New York’s BitLicense add another layer.

That’s why a U.S.-based exchange like Coinbase has to follow 50 different sets of rules. In the EU, MiCA (Markets in Crypto-Assets Regulation) became law in 2024 and now covers everything from stablecoins to decentralized exchanges. In Singapore, the MAS gives licenses only to firms that prove they can keep customer funds safe. In Japan, crypto exchanges must register and store 95% of assets in cold wallets.

There’s no single global rulebook. But there’s a growing pattern: if you’re running a business that touches crypto, you need to be licensed, audited, and transparent.

How Do You Know If a Crypto Project Is Legal?

Not every coin or token is treated the same. The key question regulators ask is: Is this a security? If yes, it falls under securities laws. The Howey Test - a 1946 U.S. Supreme Court ruling - still applies today. If people invest money in a project expecting profits from someone else’s effort (like a team developing a blockchain), it’s likely a security.

Bitcoin? Not a security. It’s decentralized. No team controls it. Ethereum? After the 2022 merge, the SEC officially said it’s not a security either. But tokens like Solana’s SOL or Cardano’s ADA? Still under scrutiny. Many projects now avoid the security label by making their tokens utility-based - meaning they’re used to access a service, not to make money from the project’s success.

Stablecoins are another hot zone. Tether (USDT) and USD Coin (USDC) are backed by real dollars. In 2025, U.S. law requires them to hold 1:1 reserves in cash or short-term Treasuries, and they must publish monthly audits. If they don’t? They get shut down. That’s why Terra’s UST collapsed in 2022 - it wasn’t backed properly. Now, no stablecoin can operate legally without proof of backing.

What Happens When You Trade Crypto?

Every time you sell Bitcoin for dollars, swap ETH for SOL, or even use crypto to buy a coffee, you trigger a taxable event. The IRS doesn’t care if you made a profit or loss - you have to report it. In 2025, exchanges like Kraken and Binance.US are required to send Form 1099-B to users who made over $10 in gains in a year. That’s down from $600 in 2024 - the threshold got tighter.

People still think, “I didn’t cash out, so I don’t owe taxes.” But that’s wrong. Trading crypto for crypto is a taxable event. If you bought 1 BTC for $30,000 and sold it for $45,000 to buy 10 ETH, you owe capital gains tax on the $15,000 profit. If you held it less than a year, it’s short-term - taxed at your income rate. If you held it over a year, it’s long-term - taxed at 0%, 15%, or 20%, depending on your income.

And yes, the IRS is catching people. They’ve been matching data from exchanges with tax returns. In 2024, they sent out 120,000 audit notices to crypto users. Most didn’t report anything. The penalty? Up to 75% of the unpaid tax - plus interest.

What About DeFi and Wallets?

Decentralized finance - DeFi - is the wild west. No central company. No KYC. Just smart contracts. But regulators are catching up. In 2025, the U.S. Treasury started requiring DeFi protocols that handle over $10 million in monthly volume to register as money services businesses. That means they need to collect user identities, report suspicious activity, and freeze accounts if ordered.

That’s why platforms like Uniswap and Aave now show warnings: “You are responsible for complying with your local laws.” They don’t collect your ID, but they’re not protecting you from legal risk anymore.

Self-custody wallets (like MetaMask or Ledger) aren’t regulated directly. But if you use them to trade on centralized exchanges, those exchanges report your activity. If you move crypto to a wallet and never touch a regulated platform? You’re in a gray zone. But if you later cash out and the IRS traces the funds back to you? You’re still on the hook.

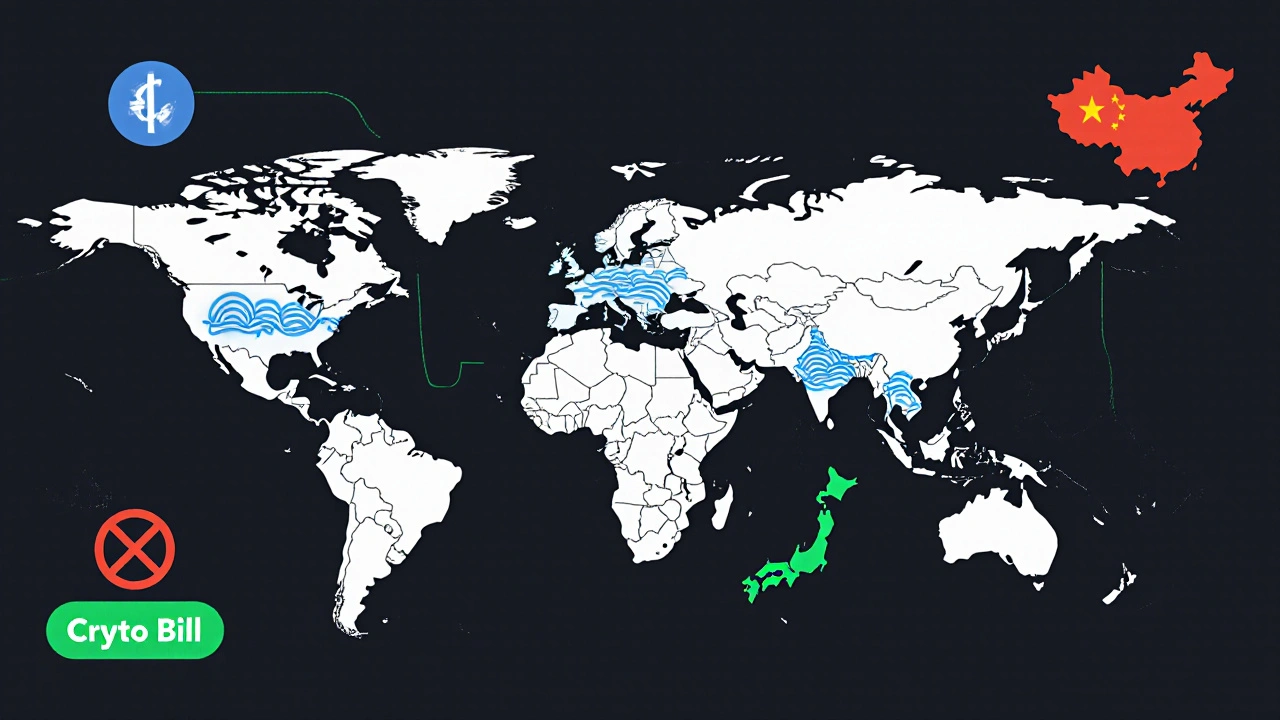

How Do Countries Compare?

Some places are welcoming. Switzerland treats crypto as a payment method and has clear licensing for token issuers. El Salvador made Bitcoin legal tender in 2021 - but adoption is still low, and the government’s Chivo wallet had security flaws that led to thefts.

China banned crypto trading and mining in 2021. That ban is still in full force. In 2025, Chinese citizens caught using foreign exchanges face fines and account freezes.

India taxes crypto at 30% since 2022, with no deductions allowed. Even gifts of crypto are taxed. The government also requires every transaction over ₹10,000 to be reported.

And then there’s the U.S. - the most complex. You’ve got federal agencies, 50 states, and no single rulebook. That’s why many crypto startups move to Wyoming, which passed the “Crypto Bill” in 2023. It gives crypto companies legal clarity: they can be treated as banks, issue tokens as securities or utilities, and operate under one state law instead of 50.

What Should You Do?

Here’s the practical checklist for anyone holding or trading crypto in 2025:

- Use only regulated exchanges - ones with proper licenses (like Coinbase, Kraken, or Gemini in the U.S.)

- Keep records of every transaction: date, amount, value in USD at the time, and purpose

- Use crypto tax software (like Koinly or CoinTracker) to auto-calculate gains and losses

- Report every trade, even crypto-to-crypto

- Don’t ignore IRS notices - respond within 30 days or risk penalties

- Never use unregulated exchanges or mixing services - they’re red flags for regulators

- If you’re building a crypto project, consult a lawyer before launch - don’t assume “decentralized” means “unregulated”

The goal isn’t to avoid regulation. It’s to work within it. Crypto isn’t going away. But the days of hiding behind anonymity are over. If you’re serious about crypto, treat it like any other asset: document it, report it, and stay informed.

What’s Next?

By 2026, the U.S. is expected to pass a federal crypto bill that unifies state rules and sets clear standards for exchanges, stablecoins, and DeFi. The EU’s MiCA will be fully enforced. More countries will follow Japan’s lead - requiring cold storage, audits, and insurance.

Regulation isn’t the enemy. It’s the bridge between chaos and mainstream adoption. The same rules that shut down unbacked stablecoins are the ones that make Bitcoin a trusted store of value. The same reporting requirements that feel invasive are the ones that let banks finally accept crypto customers.

Understanding how crypto regulations work isn’t about fear. It’s about freedom - the freedom to use crypto without risking your account, your money, or your future.

Are crypto regulations the same everywhere?

No. Each country has its own rules. The U.S. uses multiple agencies (SEC, IRS, FinCEN), the EU has MiCA, Japan requires licensing, and China bans it entirely. There’s no global standard yet, but major economies are aligning on core principles: transparency, licensing, and anti-money laundering.

Do I have to pay taxes on crypto I didn’t sell?

Yes. Any trade - even swapping Bitcoin for Ethereum - counts as a taxable event. You owe tax on the gain from the original purchase price to the value at the time of the swap. Holding crypto without selling doesn’t trigger tax, but trading it does.

Can I use unregulated exchanges safely?

No. Unregulated exchanges often lack security, don’t report to tax authorities, and can disappear overnight. In 2025, the U.S. and EU have cracked down on these platforms. Using them puts your funds at risk and may make you liable for tax evasion or money laundering charges, even if you didn’t intend to break the law.

What happens if I don’t report my crypto gains?

The IRS and other tax agencies now have direct access to exchange data. If you don’t report, you’ll likely get an audit notice. Penalties can include 25-75% of the unpaid tax, plus interest. In extreme cases, criminal charges for tax fraud are possible. Most people who get caught didn’t mean to cheat - they just didn’t know the rules.

Are NFTs regulated like other crypto assets?

It depends. If an NFT represents ownership in a company or promises future profits (like royalties from a music album), it’s likely a security and regulated by the SEC. If it’s just a digital collectible with no financial rights, it’s treated like property - taxed on sale, but not as a security. Most NFT marketplaces now require KYC and report sales over $10,000.

9 Responses

Bro in India we're getting taxed 30% on every single trade even if you're breaking even 😭 I paid more in taxes last year than my rent. But honestly? I'd rather pay than get my account frozen. At least now I know what I'm dealing with.

Stop acting like regulation is some kind of villain. You want to play with fire? Then follow the damn rules. My cousin lost 80k on some unregulated exchange last year. Now he's broke and begging for loans. This isn't a game anymore.

Regulation... as a philosophical construct, is merely society's attempt to impose order upon chaos-yet in the case of crypto, isn't it paradoxical? The very essence of decentralization resists codification... yet without structure, the system collapses under its own weight... like a house of cards in a hurricane... and yet... perhaps... the storm is necessary for the foundation to be laid...?

Just use Coinbase and keep receipts. That's it. No drama. No stress. Done. 🤷♂️

So let me get this straight... you're telling me I can't even swap ETH for SOL without the IRS breathing down my neck? This is literally worse than filing my W-2. I miss the wild west.

Y'all need to stop panicking. This is just growth. 💪 Tax software? Check. Licensed exchange? Check. Records? Check. You're not doing anything wrong-you're just doing it right now. Keep going! 🚀

SEC says Ethereum isn't a security? LOL. They changed their mind last Tuesday. And they'll change it again next month. This whole thing is a scam. The IRS is tracking your wallet through blockchain forensics. They know everything. You think you're anonymous? You're not. You're just naive.

Let me tell you something, folks. The U.S. is the only country with the guts to actually regulate this mess. Europe? They're still debating whether crypto is a currency or a mood. Japan? They're scared of their own shadow. China? They're just jealous. We're building the future. And if you can't handle the rules? Go live in a cave. 🇺🇸

Chris Atkins says 'just use Coinbase' like it's that easy. You think every Indian has a U.S. bank account? You think every guy in Delhi can get a verified Coinbase account? This isn't a U.S. problem. It's a global hypocrisy.